The rules of the telecom market are changing. Earlier the greater market share of the Telecom operator meant more customers which translates to greater profitability as there was only few operators and the incumbents like BSNL and MTNL had all the advantage. Also, as focus slowly shifted from wire line to wireless, incumbents could not adjust themselves quickly enough with the market. This gave the private players a leeway and a head start to launch their services in wireless space and slowly build the leadership position while catching up in the wire line space.

If we analyze telecom market, it’s an oligopoly. According to Charlie Munger, who was Warren Buffett's partner at Berkshire Hathaway, there are two kinds of Oligopoly. The constructive Oligopoly which allows all the companies to enjoy their respective share of the market without hurting each others margins. The destructive Oligopoly is the one which we can see now prevailing in the Indian Telecommunication market. In such a market the companies fight against each other for a larger market share but the ultimate winner is the consumer.

Not long ago, the only differentiating factor in this commodity kind of business was the call rates where it was difficult to retain subscribers and cost becomes the major deciding factor. The early mover advantage played a significant advantage but after the start of destructive oligopoly it is difficult to have sustained high return on Investment. Now, with more and more operators coming in (the number has now reached 11 per circle), the market has reached to a stage of hyper competition where players are getting into price wars and voice is rapidly getting commoditized.

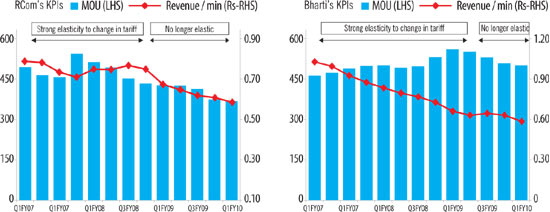

We would analyze two key telecom KPIs: Minutes of Usage (MoU) and Average Revenue per minute (ARPM). MOU refers to minutes of usage or talk-time of subscribers. “Minutes of Usage” multiplied by Average Revenue per Minute (ARPM) to arrive at Average Revenue per User (ARPU).

So equations are simple:

No. of calls * call length = MoU

MoU * ARPM = ARPU

ARPU * Market share * Market = Total revenue

ARPM has shown a declining trend with respect to time but remained resilient through increase in MoU by launching creative campaigns and pricing strategies. But now, MoUs are no longer showing sensitivity to tariffs despite sharp cuts in tariffs and revenue per minute too is falling sharply.

In an analyst’s language we call this a declining MoU elasticity. So we can see the trend:

ARPM Declining, MoU inelastic to price and stabilizing and hence ARPU declining.

In the past, price cuts typically resulted in more traffic on the networks as users increased talk time and hence increased MoU. So despite lower tariffs, telecom companies managed to protect profitability. But now, even that may become difficult as many telecom companies are struggling with spectrum-constrained networks. They may be close to exhausting their limits of taking on additional traffic. As recent TRAI reported that penetration in the urban areas already cross 100% mark, we see a clear trend of telcos to go rural going forward. Also, we can see other factors playing out such as bandwidth limitation in the urban areas leading to crowding up the spectrum by adding too many subscribers/Mhz which would create problems in QoS. So there is also a limit to that. However,China

In the past, price cuts typically resulted in more traffic on the networks as users increased talk time and hence increased MoU. So despite lower tariffs, telecom companies managed to protect profitability. But now, even that may become difficult as many telecom companies are struggling with spectrum-constrained networks. They may be close to exhausting their limits of taking on additional traffic. As recent TRAI reported that penetration in the urban areas already cross 100% mark, we see a clear trend of telcos to go rural going forward. Also, we can see other factors playing out such as bandwidth limitation in the urban areas leading to crowding up the spectrum by adding too many subscribers/Mhz which would create problems in QoS. So there is also a limit to that. However,

The only way to survive in this market is to identify the profit elements in this business and differentiate in the service offerings. Price is no longer a differentiator as all operators would match up with each other’s pricing strategies sooner or later. The real differentiators in this case would be:

- QoS (Quality of service)

- Greater emphasis on CRM and customer life-cycle management

- Greater focus on alternative revenue models

No comments:

Post a Comment